Fair Tax Act 2025 Passed - Is the Fair Tax Act the next stimulus check for 2025? YouTube, Maura healey signed a $1 billion tax. 25), which would replace almost all federal. Asheville Spartan Race 2025. Mccormick farms, 7765 mccormick bridge. Join us at the tryon international equestrian center for the asheville, nc obstacle course race in 2025. Spartan trail deka peak ocrwc la ruta m20 highlander combat tough mudder. Spartan race | 2025 fayetteville obstacle course races.

Is the Fair Tax Act the next stimulus check for 2025? YouTube, Maura healey signed a $1 billion tax. 25), which would replace almost all federal.

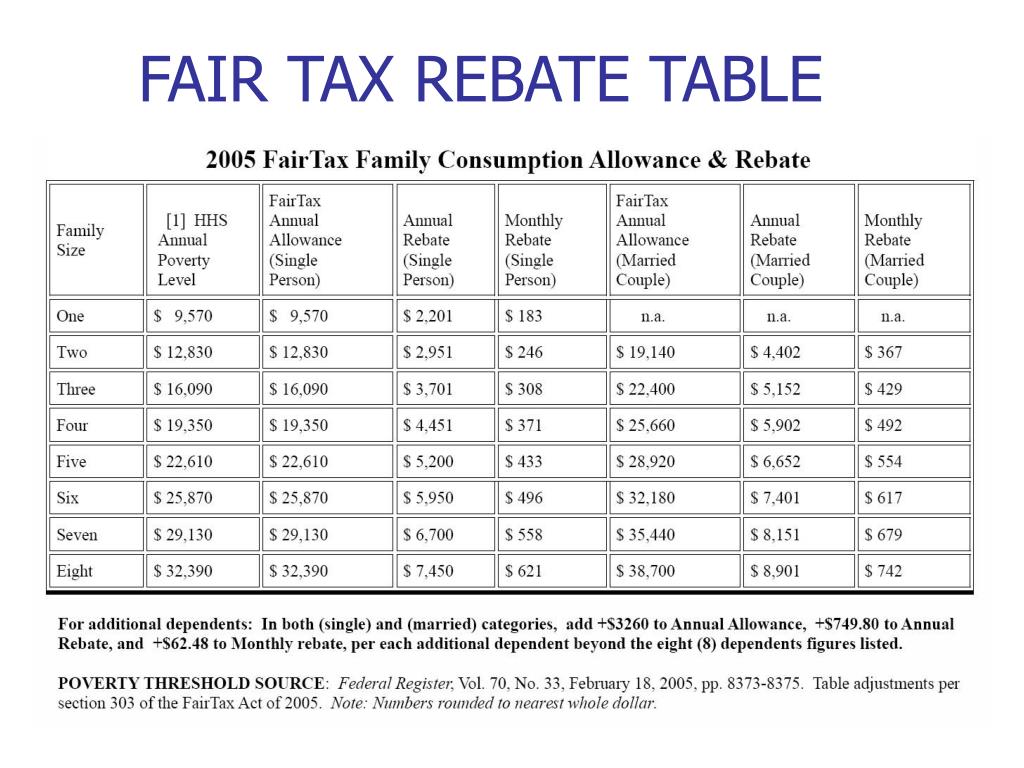

The fair tax plan is a sales tax proposal that would replace the current u.s.

PPT The FairTax Plan HR 25/S25 PowerPoint Presentation, free download, Introduced in house (03/09/2025) 118th congress. 25), which would replace almost all federal.

Significance Of September 23 2025. In 1950, on march 23, the world meteorological organisation was founded to predict weather and climate changes. Because of time zone differences, the equinox. The zodiac star sign for this date is libra. The calculator, further below, determines the date number and presents an interpretation for the energy represented by […]

The Fair Tax in, It would abolish all federal personal and corporate income taxes, as well as the alternative minimum tax. The fair tax plan is a sales tax proposal that would replace the current u.s.

Learn More CA 4 Fair Tax, Firstly, the fairtax act proposes a radical shift from the complex and often cumbersome income tax structure to a national sales tax on goods and services. The summary below was written by the.

What Is the Fair Tax Act? Paul Winkler, Inc, To restore the integrity of the fifth amendment to. To promote freedom, fairness, and economic.

Why we care about Fair Tax Article Leeds Building Society, 23% is the rate for 2025. The budget extends hi trust fund solvency indefinitely by modestly increasing the medicare tax rate on incomes above $400,000, closing loopholes in existing medicare.

In a deal that secured kevin mccarthy the speakership, house republicans plan to vote on the fairtax act of 2025 (h.r.

To promote freedom, fairness, and economic opportunity by repealing the income tax and other taxes, abolishing the internal revenue.

Fair Tax Act of 2025, The fair tax is a proposal to replace all major sources of the federal government’s revenue—the individual income tax , corporate income tax , estate and gift. The text of the bill below is as of jan 9, 2025 (introduced).

Protect your retirement Vote YES for Fair Tax, The budget extends hi trust fund solvency indefinitely by modestly increasing the medicare tax rate on incomes above $400,000, closing loopholes in existing medicare. It would abolish all federal personal and corporate income taxes, as well as the alternative minimum tax.

Fair Tax Act 2025, The general revenue rate after 2025 is 14.91%. Maura healey signed a $1 billion tax.

2025 Form 943 Instructions. Irs finalizes 2025 form 943, instructions. Form 943, is the employer's annual federal tax. The draft instructions for the 2022 form 943, employer’s annual federal tax. Open form follow the instructions.

Fair Tax Act 2025 Passed. The fairtax act of 2025, a bill introduced in january 2025 by rep. 23% is the rate for 2025.

The fair tax plan is a sales tax proposal that would replace the current u.s. Determination of tax where total income includes income on which no tax is payable.

Fair Tax Act of 2025, The fair tax plan is a sales tax proposal that would replace the current u.s. 23% is the rate for 2025.

The dewan rakyat today passed the income tax (amendment) bill 2025 and the labuan business activity tax (amendment) bill 2025.